West Virginia Delinquent Tax Sale 2025. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax. The wv property tax division annually creates a master surface tax parcel files from the gis parcel files provided by the county assessors and property attributes from the.

Wv legislature passed senate bill 552 into law during this year’s. Sales tax is imposed on the sale of goods and services by the vendor at the time of purchase.

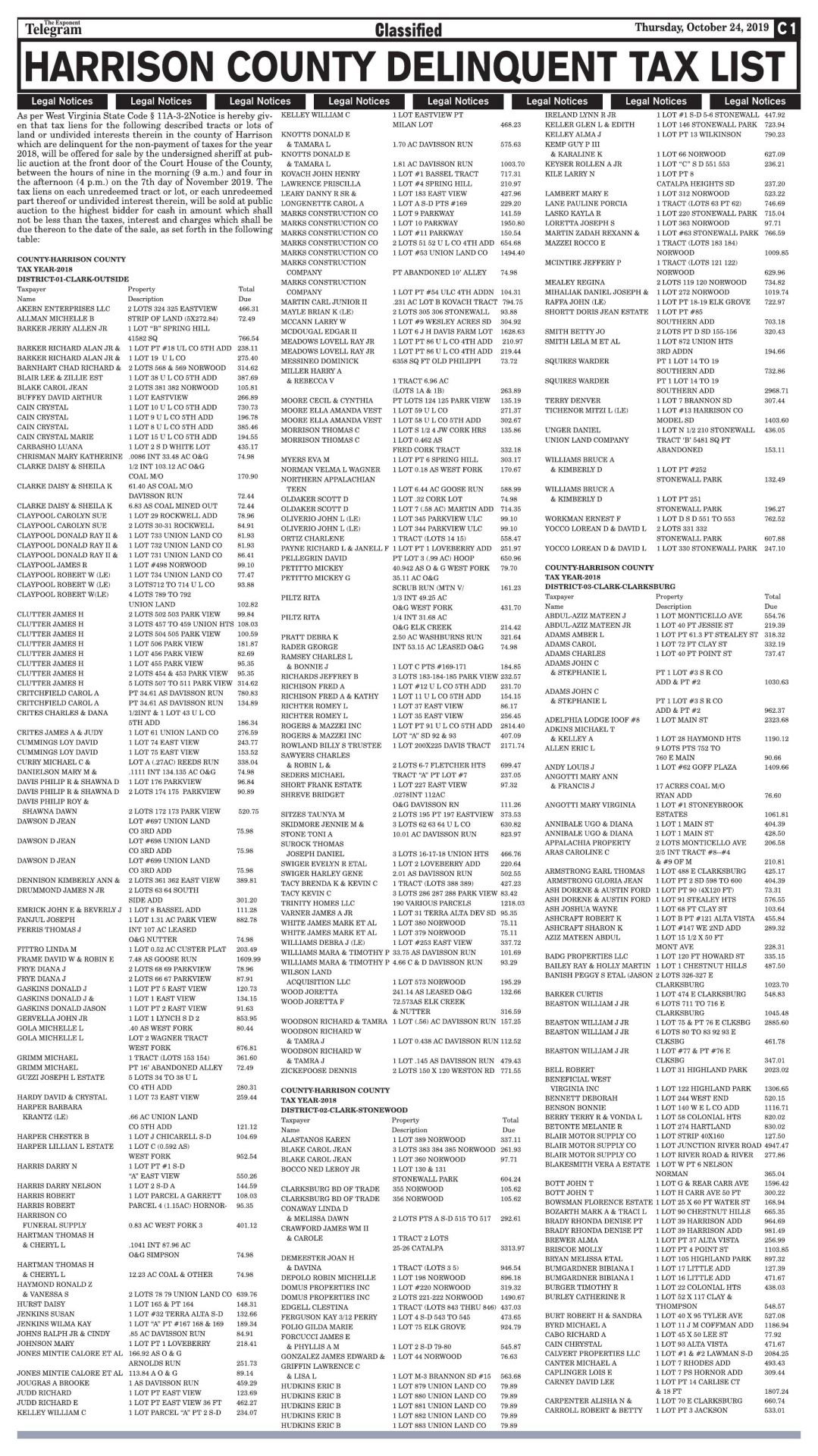

West Virginia Delinquent Tax Sale 2025 Ally Lulita, Notice is hereby given that tax liens for the following described tracts or lots of land or undivided interests therein in the county of greenbrier which are delinquent.

Jefferson County Delinquent Tax List 2025 Nana Kessiah, Kip & sandra blake requests that you.

Virginia 2025 Estimated Tax Form Daron Emelita, West virginia delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details.

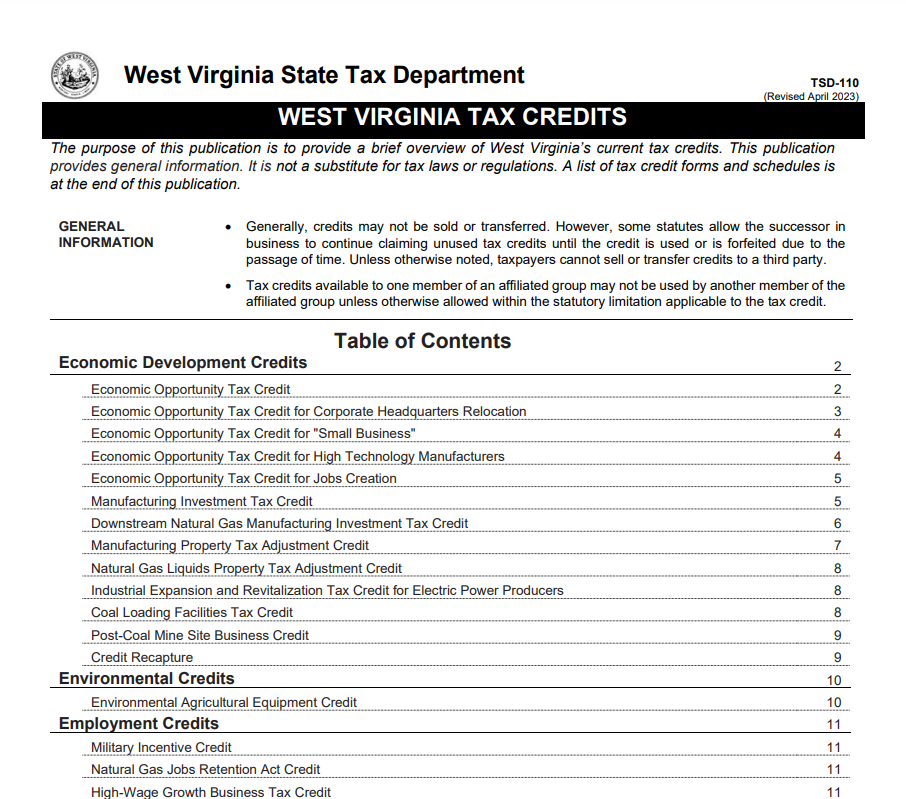

West Virginia Tax Rebate 2025, Claiming Tax Rebates, WV Tax Relief, Starting on monday, september 9, 2025, a listing of properties will be available on the charleston county website and in the delinquent.

Rockbridge County, VA Sale of Tax Delinquent Real Estate, County sheriff’s departments no longer auction land for delinquent property taxes, after a change in state law.

Henrico County, VA Sale of Tax Delinquent Real Estate, (a) on or before the september 10 of each year, the sheriff shall prepare a second list of delinquent lands, which shall include all real estate in his or her county.

West Virginia Delinquent Tax Sale 2025 Map Korry Mildrid, County sheriff’s departments no longer auction land for delinquent property taxes, after a change in state law.

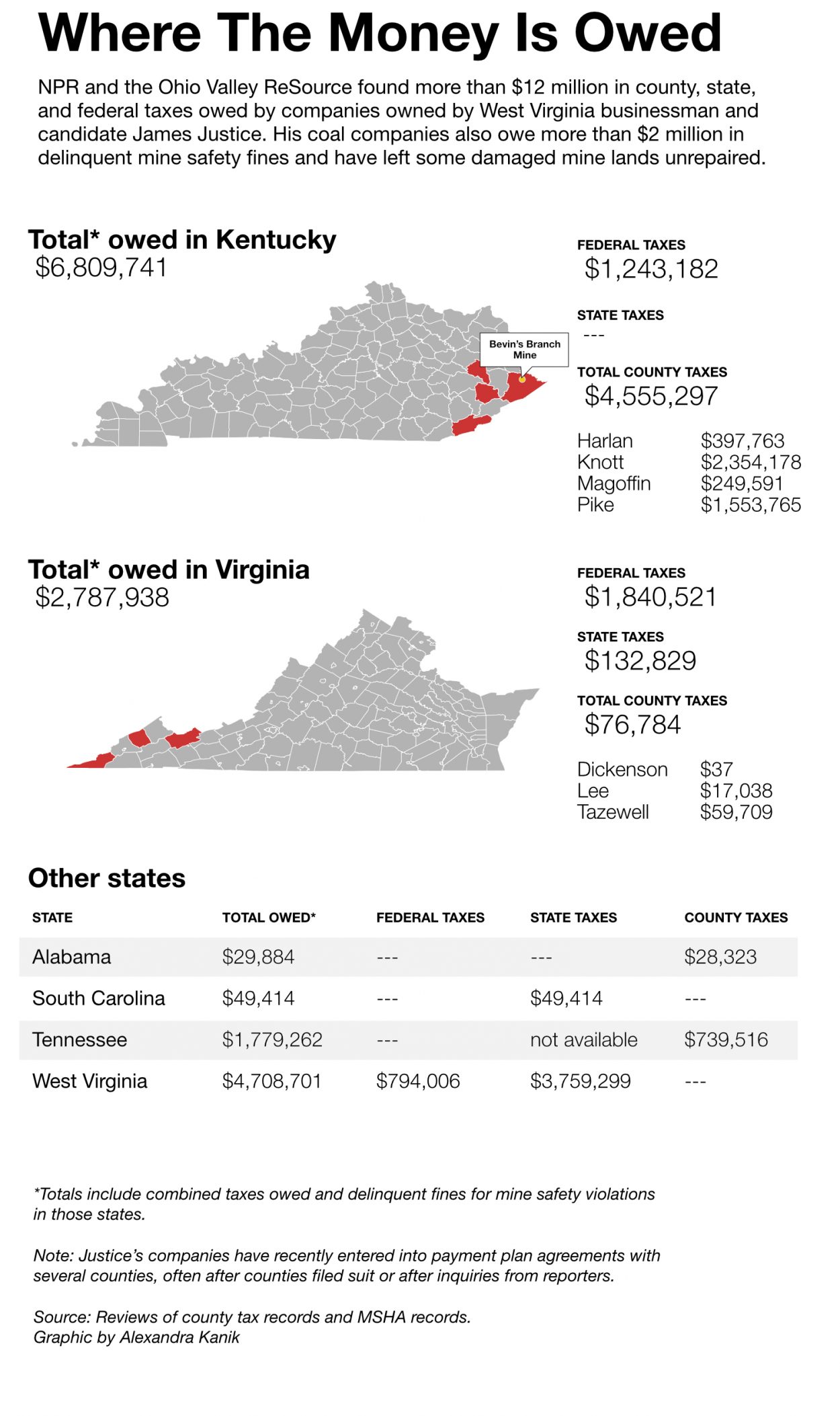

Richland County Delinquent Tax Sale 2025 Megen Sidoney, In west virginia, delinquent real property taxes are sold as tax liens at an annual public auction with the purchaser receiving a certificate of sale.

Horry County Delinquent Tax Sale 2025 Schedule Perry Brigitta, All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check, money order, certified check, or united.